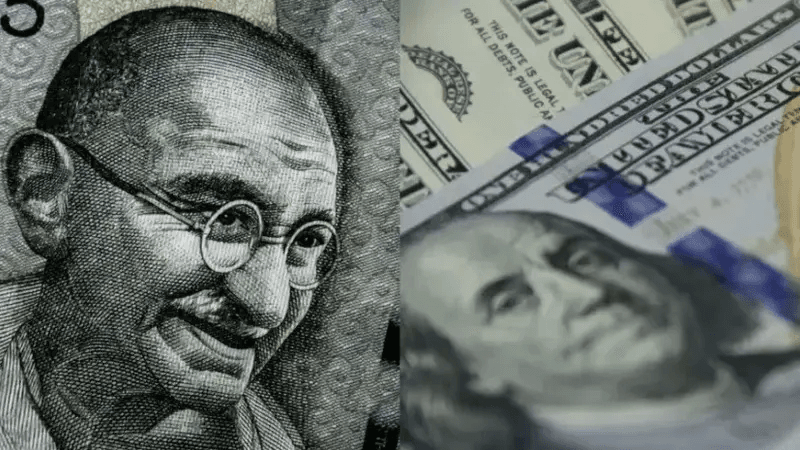

Mumbai: The rupee slipped 1 paisa to an all-time low of 84.38 against the US dollar in early trade on Monday, weighed down by persistent foreign fund outflows and a muted trend in domestic equities. Forex traders noted that the rupee is likely to remain under pressure unless there is a softening in the dollar index or a slowdown in foreign fund outflows. At the interbank foreign exchange, the rupee opened at a record low of 84.38 against the greenback, registering a fall of 1 paisa over its previous close.

On Friday, the rupee had dropped 5 paise to hit a new lifetime low of 84.37 against the US dollar, marking a decline for the third straight session. The rupee faced pressure last week amid the US elections and sustained foreign fund outflows. After nearly USD 12 billion in equity sell-offs in October, foreign funds have continued their retreat in November, with outflows of around USD 1.6 billion recorded in just the first 10 days.

This trend reflects the overvaluation of Indian equities and disappointing Q2 earnings, according to CR Forex Advisors Managing Director Amit Pabari. “In the medium term, the rupee is expected to trade within the 83.80 to 84.50 range, as the Reserve Bank seems to cap the rupee’s downside with sufficient Forex reserves,” Pabari added. Meanwhile, the dollar index, which measures the greenback’s strength against a basket of six currencies, was trading higher by 0.05 percent at 105.05. Brent crude, the global oil benchmark, fell 0.37 percent to USD 73.60 per barrel in futures trade.

On the domestic equity market front, the Sensex was trading 12.47 points, or 0.02 percent lower, at 79,473.85 points, while the Nifty fell 5.65 points, or 0.02 percent, to 24,142.55 points. Foreign Institutional Investors (FIIs) were net sellers in the capital markets on Friday, offloading shares worth Rs 3,404.04 crore, according to exchange data. Meanwhile, India’s forex reserves declined by USD 2.675 billion to USD 682.13 billion for the week ended November 1, the RBI reported. In the previous week, reserves had fallen by USD 3.463 billion, dropping from an all-time high of USD 704.885 billion in September.