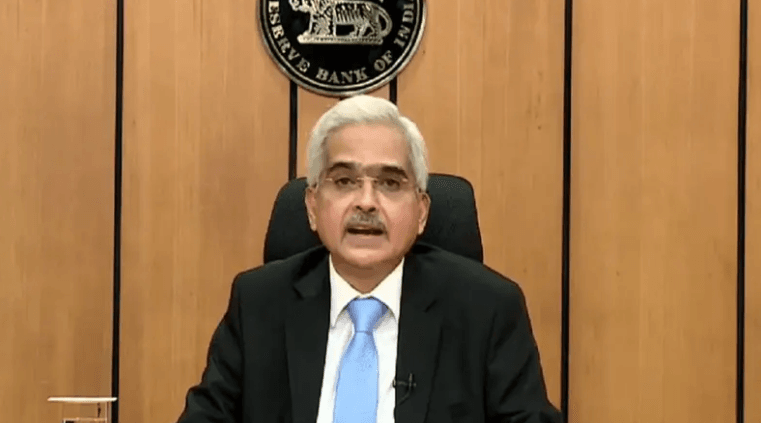

RBI MPC:The Monetary Policy Committee of the Reserve Bank of India ( RBI ), in its meeting conducted on October 9, 2024, has kept the repo rate unchanged at 6.5 per cent. As part of containing inflation but still supporting growth, the MPC had some crucial updates in store. Here are some highlights from the RBI MPC Meeting as follows:

Repo Rate Unchanged: RBI decided to leave the repo rate unchanged at 6.5 per cent for the 10th successive meeting, with a majority vote of 5:1.

Stance Shifts to ‘Neutral’: The MPC shifted the stance from ‘withdrawal of accommodation’ to being ‘neutral’, which may indicate a cut in the monetary policy rates later.

Inflation Projection Remains Steady: The inflation estimate for FY25 remains unchanged at 4.5 per cent. Food inflation is likely to ease further in the latter half of the fiscal year.

GDP Growth Projection Steady: The RBI maintained its estimated growth in the economy for FY25 at 7.2 per cent while making minor changes to the quarterly estimates.

No change in CRR and SLR: CRR and SLR are at 4.5 per cent and 18 per cent, respectively, and the statistics are steady.

UPI Limits Hiked: The amount that can be transacted through UPI123Pay has been upped to Rs 10,000 from Rs 5,000. The wallet limits of UPI Lite have also been increased to expand digital payments for access.

Expanded MSE Loan Guidelines: New guidelines would prevent foreclosure from being charged on the floating rate term loan of micro and small enterprises by banks.

Discussion Paper on UCBs: RBI would come out with a discussion paper on the capital raising options for Urban Cooperative Banks to add greater financial flexibility to them.

Climate Risk Data Initiative: The RBI would unveil the Reserve Bank – Climate Risk Information System (RB-CRIS) to strengthen data availability to access climate-related financial risks.

Beneficiary Account Name Verification: Beneficiary account name verification would enable a remitter to verify the account-holders’ names before making a transaction, thus reducing the impact of fraudster elements.