RBI Monetary Policy Meeting:In its latest monetary policy meeting, the Reserve Bank of India ( RBI ) kept the repo rate unchanged at 6.5 per cent for the 10th consecutive time. The decision, made by a majority of 5 out of 6 members of the Monetary Policy Committee (MPC), comes amid concerns about inflation and global uncertainties.

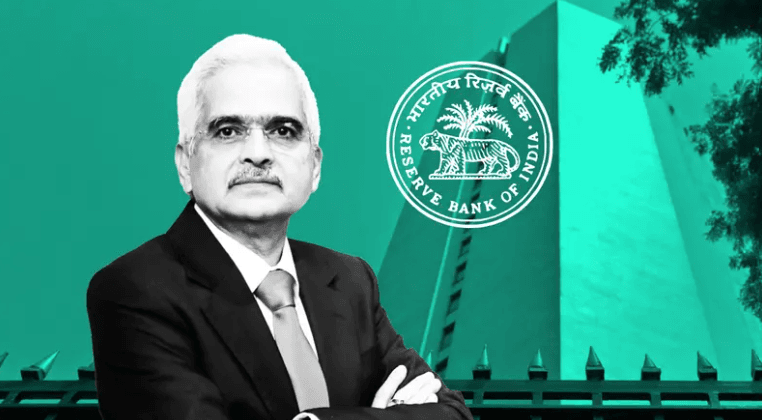

RBI Governor Shaktikanta Das, in his address, announced a shift in the policy stance to “neutral”, stating that the central bank would focus on the durable alignment of inflation with its target while supporting growth. He noted that adverse global events pose a major threat to food inflation, a concern that continues to weigh heavily on the economy.

The MPC, now featuring three new external members, aims to strike a balance between inflation control and fostering economic growth as global risks continue to challenge the domestic economic landscape.

India’s real GDP growth for Q1 stood at 6.7 per cent, driven by a revival in private consumption, while Gross Value Added (GVA) increased by 6.8 per cent. High-frequency indicators have shown steady growth, with manufacturing PMI at 56.5 and services PMI at 57.7 for September, indicating robust expansion.

The RBI projects real GDP growth at 7.2 per cent for 2024-25, with quarterly growth expected to rise steadily in Q2 (7 per cent), Q3 (7.4 per cent), and Q4 (7.4 per cent).