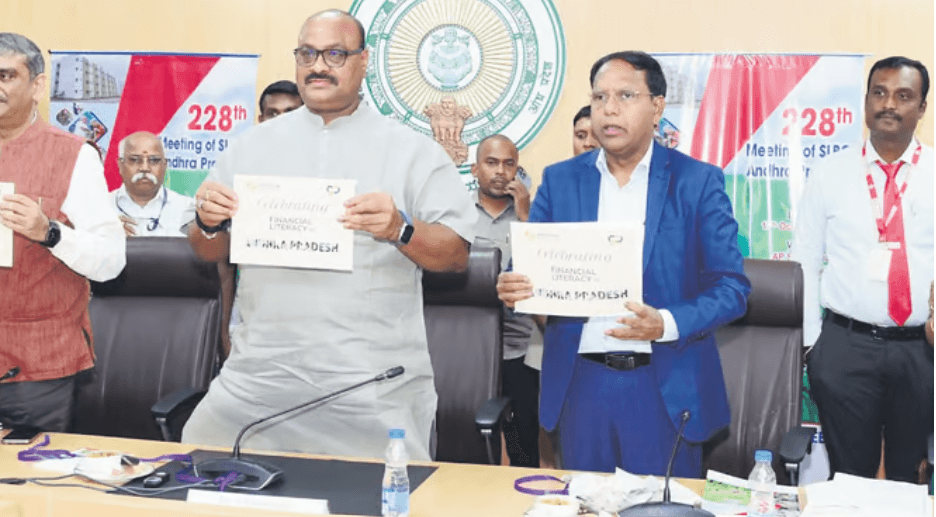

VIJAYAWADA: Banks should adopt a humane approach and lend to tenant farmers, said Minister for Agriculture K Atchannaidu, while chairing the 228th State Level Bankers’ Committee (SLBC) meeting at the State Secretariat on Thursday.

He urged the bankers to help the State government in realising its goal of bringing 50 lakh acres under natural farming in the next five years. The banks should also hand-hold the MSME sector, besides effectively implementing the various poverty alleviation schemes.

“There are nine lakh Crop Cultivator Rights Card holders (tenant farmers) in the State, but only 2 lakh have secured bank loans,” he pointed out, drawing the attention of bankers to the need of extending loans to tenant farmers liberally.

Mentioning the six new policies unveiled by the government to promote rapid economic growth, the Agriculture Minister urged the banks to extend support to the youth in various fields. The government is setting targets for banks pertaining to the implementation of various Central schemes like Pradhan Mantri MUDRA Yojana and PM Vishwakarma Yojana. The banks should strive to realise the targets, he said.

Atchannaidu said the previous regime diverted the funds allocated to various sectors to other needs, crippling development. The present government has been working for the past four months to put the State back on the path of growth. “Banks should also contribute to the various development and welfare schemes of the Centre and the State government,” he said.

Atchannaidu thanked the banks for extending assistance to the government in the implementation of relief and rehabilitation measures during the recent floods.

Union Bank of India MD and CEO A Manimekhalai congratulated the government on behalf of all the banks for implementing many innovative programmes and schemes aimed at Swarna Andhra @2047 with a simple and effective governance system, especially with the help of technology.

With regard to the implementation of the annual credit plan of 2024-25, Rs 3,75,000 crore loans need to be provided to the priority sectors. In the first quarter of the current fiscal, 36% of the target was achieved by extending Rs 1,36,657 crore. In the agriculture sector, 34% of the loan target was achieved, lending Rs 89,438 crore.

Extending Rs 87,000 crore, 51% of the credit plan target was realised in MSME sector, she explained. Earlier, SLBC convenor and Union Bank of India General Manager CVN Bhaskara Rao gave details of the agenda through a PowerPoint presentation.

He highlighted the progress achieved by the banks in implementation of the annual credit plan in the first quarter (up to June 30).